To comply with the DMA, Apple will reportedly allow alternative app stores in the next version of iOS. According to Bloomberg, the project is already underway. Additionally, there has been talk of opening up Apple’s camera and Near Field Communication (NFC) to developers. Importantly, the NFC stack that Apple currently makes available to developers does not include card emulation, which means only Apple can develop an integrated payment wallet on iOS (Apple Pay).

This is potentially huge news for app developers. App sideloading will drive app store competition on iOS, app developers will no longer be forced to pay Apple’s fee (of up to 30%) for in-app purchases, and widening access to NFC technology would facilitate alternative tap-and-pay enabled wallets.

However, Apple’s cynical dealings with regulators in the past, and Google’s example of running an open operating system, in theory, whilst adding friction to discourage use of non-Android apps and services, might temper expectations of a magic legislative bullet.

Apple’s head-to-head with the Dutch competition regulator, the Netherlands Authority for Consumers and Markets (ACM), is, indeed, illustrative of the capacity of these companies to resist obligations set out under the law, whilst claiming compliance. Following a complaint against Apple’s excessive payment charges from a number of dating app developers, the ACM ordered Apple to allow dating apps to use third-party payments systems within the app. Consistent with the order, Apple allowed dating apps to link out or use a third-party in-app payment provider, but added the outrageous proviso that this would be subject to a 27% tax. [1]

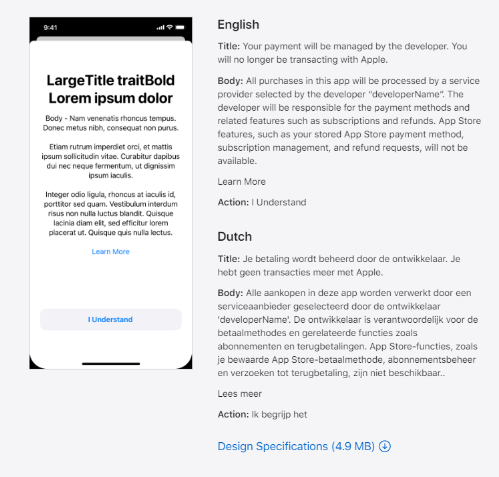

Despite weekly 5 million euro fines from the ACM, the company held their ground on this clearly untenable point for an inordinate amount of time; Apple had racked up 25 million euros in penalties by the time regulators were satisfied with their compliance. [2] Though the fee for enabling third-party payment systems is now a more reasonable 3% per transaction, Apple continues to put up discouraging barriers to developers and consumers. The many-stepped process is outlined here and the following image shows the off-putting disclaimer that Apple requires developers present to each consumer when using a non-native payment solution.

Considering the company was willing to fight tooth and nail and hand over tens of millions of dollars in penalties, in order to protect their payments monopoly over Dutch dating apps, it would be wishful thinking to expect an immediate Europe-wide capitulation. Apple surely has some cards yet to play.